How To Use The Connecticut Bank Rate Recap

PLEASE REVIEW THE INFORMATION BELOW

CAREFULLY BEFORE USING THE CT BANK

RATE RECAP SURVEYS!

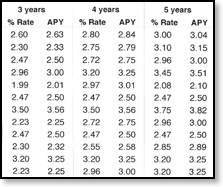

Deposit accounts are divided into two

sections,

one for

fixed rate certificates of deposit (CD’s) and the other for

liquid accounts (savings, money market and NOW/interest

bearing checking accounts.) Separate tabbed sheets include

samplings of "Premium Rate" CD's and CD's with non-standard

maturities (4, 5, 7 months etc.)

Interest

Rates and Yields

Interest rates are expressed as an annual percentage rate.

Yields are annual percentage yields (APY's) based on all

principal and interest remaining on deposit at the stated

annual interest rate for a full year. Rates and APY's are

rounded to 2 decimal places.

Minimum

Deposit Account Requirements

Most CD's quoted are for a $1,000 minimum deposit unless

otherwise noted. Savings and Money Market minimums are

noted at the head of each column. Minimums to avoid fees on

Savings and Money Market accounts vary and may not match

the minimum opening balance. Check with the financial

institution.

Personal

and Business use

Accounts surveyed are personal accounts. Please check with

the individual financial institution for rates and

maturities.

Some

banks accept deposits only from customers

who live

or work in the market areas served by their branch network.

In addition, credit union rates are only available to

credit union members. Call or visit the credit union web

site for membership requirements.

Business

use of certain savings, money market or NOW accounts is

often restricted or unavailable. Please

call the individual financial institution.

Survey

Summaries

At the end of the CD and Liquid Accounts sections are rows

that summarize the survey findings for the week just

completed.

Please

Note For Deposit Account Rates:

Rates and APY's quoted are those given to Connecticut Bank Rate Recap during the week of the survey by the financial institution listed. Deposit interest rates are deregulated and subject to change without notice! Connecticut Bank Rate Recap is not responsible for the accuracy of the rates listed. Please call the financial institution to confirm the accuracy and availability of rates and yields as well as minimum deposit requirments. CD’s usually are subject to substantial penalties for premature withdrawal. Fees may reduce earnings on accounts. Connecticut Bank Rate Recap makes no recommendations regarding account types or individual financial institutions or any representation as to the safety or soundness of the financial institutions surveyed.

Please Note For Loan Rates:

Rates and points quoted are those reported to Connecticut Bank Rate Recap during the week of the survey by the financial institution listed. Many interest rates, annual percentage rates (APR's) and terms are reviewed by financial institutions daily and are subject to change without notice! Connecticut Bank Rate Recap is not responsible for the accuracy of rates listed. Please call the financial institution to confirm accuracy and availability of loan rates and terms. Many loan products are available only to residents of specific geographic areas served by a financial institution's branch network. Connecticut Bank Rate Recap makes no recommendations regarding specific loan products, individual financial institutions or any representation as to the safety or soundness of the financial institutions surveyed.